Table of Contents

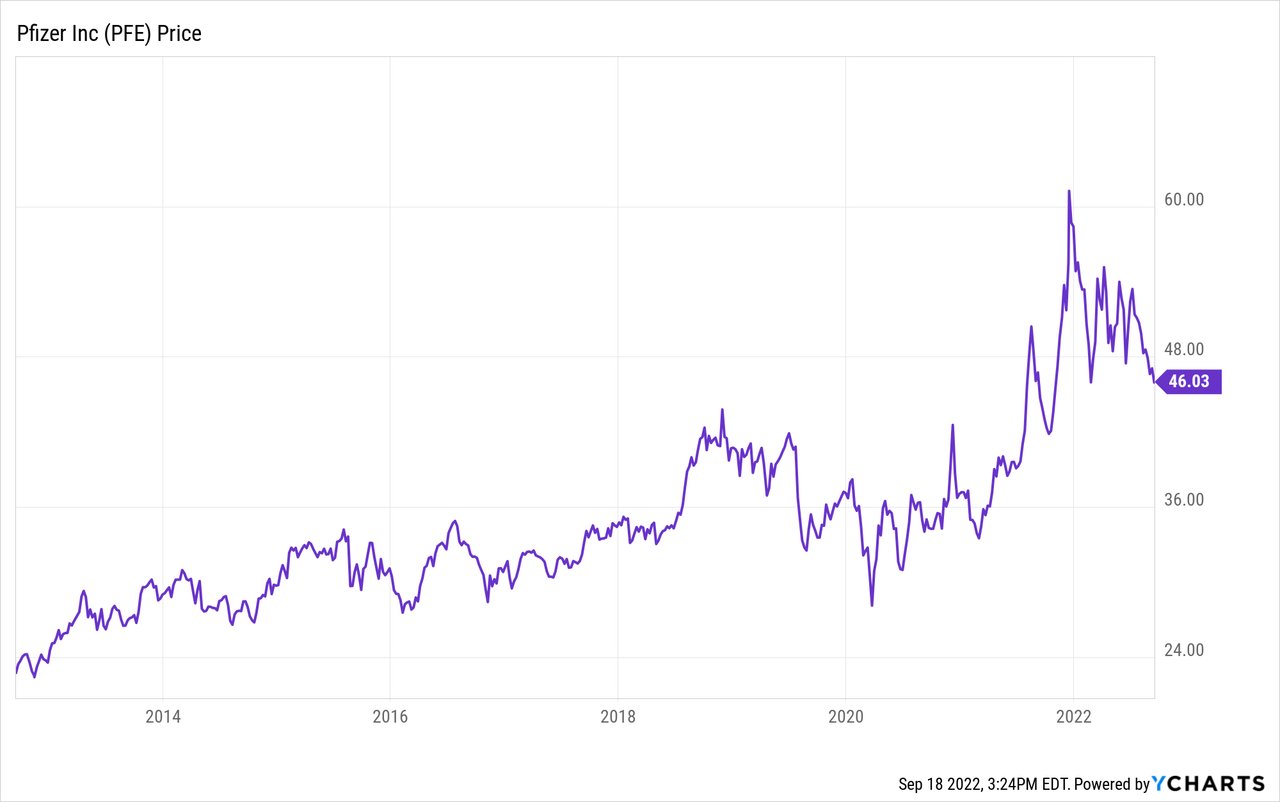

- Pfizer Stock: The Best Long-Term Investment Setup Since 2009 (NYSE:PFE ...

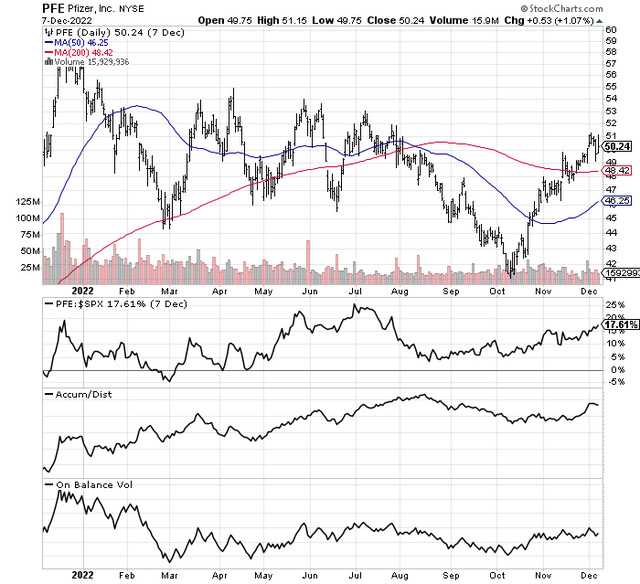

- Time to Bail on Pfizer Stock? Let’s Look at the Charts | InvestorPlace

- Pfizer Stock Will Gain Because Its Pipeline Has Promise, Analyst Says ...

- Time to Bail on Pfizer Stock? Let’s Look at the Charts | InvestorPlace

- How to Buy Pfizer Stock | Invest in PFE

- Pfizer Wallpapers - Wallpaper Cave

- Pfizer logo

- Pfizer Stock As A Recession Play (NYSE:PFE) | Seeking Alpha

- Pfizer: The Best Big Pharma Dividend Stock (NYSE:PFE) | Seeking Alpha

- FDA approves etrasimod, Pfizer’s oral drug for ulcerative colitis

Current Stock Price and Performance

News and Announcements

Market Analysis and Trends

According to data from MarketBeat, Pfizer's stock has been rated as a "hold" by the majority of analysts, with a consensus target price of $45.50. The company's revenue growth has been steady, with a 5-year average annual growth rate of 4.3%. However, the pharmaceutical industry as a whole is facing significant challenges, including increased competition, regulatory pressures, and patent expirations. Despite these challenges, Pfizer's strong pipeline of new products and its diversified portfolio of established brands are expected to drive long-term growth. The company's commitment to research and development, with a significant investment of $8.3 billion in 2022, is also expected to yield future returns. In conclusion, Pfizer's stock price, news, and market trends present a mixed picture. While the company faces challenges in the pharmaceutical industry, its strong pipeline, diversified portfolio, and commitment to research and development position it for long-term growth. Income investors may find the stock's dividend yield attractive, while growth investors may want to wait for a clearer picture of the company's future prospects. As always, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.Stay up-to-date with the latest news and analysis on Pfizer stock by visiting MarketBeat.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. The author and publisher are not responsible for any losses or gains resulting from the use of this information.